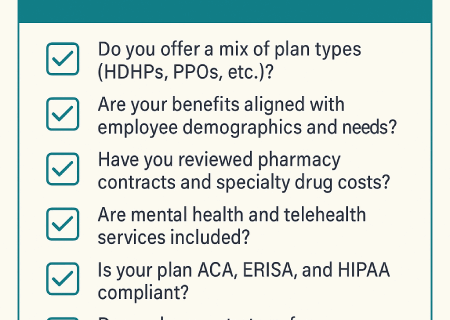

As healthcare costs continue to rise and employee expectations evolve, group healthcare benefits are undergoing a major transformation in 2025. Employers are no longer just offering coverage—they’re strategically designing benefits to attract talent, manage costs, and support employee well-being. Here’s what’s trending and how PF Compass can help your organization stay ahead. Key Trends in Group Healthcare Benefits Level-Funded and Self-Funded Plans Smaller businesses are increasingly adopting level-funded plans, which combine the predictability of fully insured premiums with the cost-saving potential of self-funding. These plans offer more flexibility and transparency, especially when paired with strong analytics and claims support. Personalized Plan Designs Employers are moving away from one-size-fits-all coverage. Popular options include: High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs) Wellness incentives and mental health support Telehealth services and preventive care programs Cost Management Strategies With healthcare costs projected to rise by over 9% in 2025, employers are: Increasing employee contributions Conducting pharmacy contract reviews to manage specialty drug costs Steering employees toward high-performance provider networks Technology-Driven Benefits Administration HR tech platforms are streamlining enrollment, compliance, and communication. Employers are leveraging AI tools to personalize benefits and improve utilization. How PF Compass Can Help PF Compass is more than a broker—it’s a strategic partner for businesses navigating the complexities of group healthcare benefits. Here’s how they add value: ✅ Comprehensive Plan Reviews PF Compass offers complimentary plan reviews to help employers assess their current benefits, identify gaps, and uncover cost-saving opportunities. ✅ Customized Benefit Strategies Whether you’re a company of 5 or 500+, PF Compass tailors solutions to your workforce’s needs. They work with all major carriers and offer: Creative plan designs Compliance support Claims adjudication COBRA administration ✅ Education & Communication PF Compass bridges the gap between benefits and understanding. Their team provides clear guidance to help employees make informed decisions—reducing stress and improving engagement. ✅ Technology & Support Clients receive access to simple, effective platforms with live support, making benefits administration seamless and scalable. ⚖️ Compliance & Regulatory Support Navigating healthcare regulations can be overwhelming. PF Compass helps employers stay compliant with: ACA reporting and tracking ERISA and COBRA requirements HIPAA privacy and security standards State-specific mandates and updates Their team monitors legislative changes and ensures...

Read MoreIn today’s business climate, navigating healthcare costs effectively while still offering competitive benefits is a critical challenge for many employers. With rising premiums and the ever-evolving landscape of healthcare regulations, it’s crucial to find a balance that keeps your workforce healthy and your finances in check. Here are 8 practical tips for employers looking to navigate these tricky waters. 1. Educate Your Employees on Healthcare Utilization One of the most effective ways to manage healthcare costs is to ensure that your employees are well-informed about how to use their benefits wisely. Education can focus on the importance of preventive care, when to use urgent care instead of the emergency room, and the benefits of using generic drugs. Regular workshops or seminars can help employees make informed decisions that save money for both them and your company. Your broker should be your education resource. 2. Embrace Telehealth Options Telehealth has surged in popularity and utility, particularly highlighted by the global shift during the pandemic. Offering telehealth options as part of your healthcare plan can reduce costs significantly by cutting down on unnecessary office visits and providing easier, quicker access to care. This not only saves on costs but also increases employee satisfaction and convenience. 3. Invest in Wellness Programs Wellness programs are no longer just a nice-to-have; they’re a must-have in the modern workplace. Programs that promote physical activity, mental health, nutrition, and smoking cessation have shown to reduce healthcare costs by improving overall employee health. Healthier employees tend to incur lower healthcare costs, and programs can often be tailored to the specific needs of your workforce. 4. Analyze Your Data Utilize data analytics from your broker to understand where your healthcare costs are coming from. Look at the health claims filed by your employees to identify any patterns or prevalent health issues within your workforce. With this data, you can better tailor your health plans and wellness programs to address those specific needs, potentially reducing overall costs. 5. Consider Different Plan Options It might be beneficial to offer a range of plan options. For example, high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) can be an excellent choice for younger, healthier employees who don’t often visit doctors...

Read MoreAs an employer, are you paying attention to what is stressing out your employees? Mental health options are an integral part of overall health and well-being, yet often go unrecognized or neglected in many group health care plans. Many employers offer physical health benefits that cover doctor visits, prescriptions, and other preventative services but often overlook the importance of mental health care. This oversight can have serious consequences for both employees and businesses alike, leading to increased stress and decreased productivity. A recent survey of over 1,000 employees by JobSage, an employee transparency platform revealed the following disturbing statistics: 41% of Americans are considering quitting their jobs. 67% of employees say they are stressed by their jobs (compared to 54% in 2022). 55% of employees say they are anxious because of job aspects (compared to 36% in 2022). Fortunately, there are several ways employers can incorporate mental health options into their group health care plans to ensure their employees’ physical and mental health are protected. Here are five suggestions to boost up your overall package and help you attract and retain high level talent. Provide access to mental health professionals. This can be done in a variety of ways, such as providing a list of in-network mental health providers, offering coverage for telehealth services, or even providing on-site counseling services. Consider offering coverage for mental health services. This could include cognitive behavioral therapy, psychotherapy, and medication management. Ensure health plans have adequate coverage for mental health issues. Coverage for both in-person and virtual visits, as well as coverage for prescription medication may encourage more employees to seek the help they would benefit from. Consider offering coverage for alternative treatments. Treatments like acupuncture, massage therapy, and nutritional counseling are becoming more and more desirable when potential employees are comparing benefits as part of an overall job offer. Create a supportive work environment for employees. This can include offering flexible work schedules, providing paid time off for mental health days, and offering workshops or seminars on topics such as stress management and mindfulness. By creating an environment that encourages employees to take care of their mental health, employers can help reduce the stigma associated with mental health issues and create a...

Read MoreWe are excited to announce our relocation to a new state of the art 4,000 sq. ft. office, centrally located at 440 US 22E, Bridgewater, NJ. The space was designed by SNS Architects & Engineers, PC and features a large conference room, a small break out room with video conferencing functionality, two mini-offices for private conversations and large open floor plan. “Our goal was to create a beautiful new space to continue facilitating team collaboration and an enhanced working environment. As we expand our business we felt it vital to offer a first class space to host our local client and vendor meetings, while also integrating cutting edge technology to communicate with all clients” said Partner Brian Honan. Brandi Bowers | Benefits ConsultantPF Compass Employer Guidance & Benefit Solutions 440 Route 22, E., Suite 190Bridgewater, NJ 08807Tel (732) 258-1032...

Read More