Employee Benefit Guidance & Compliance Solutions

Our Partners »

EXPLORE PF Compass

Our Purpose

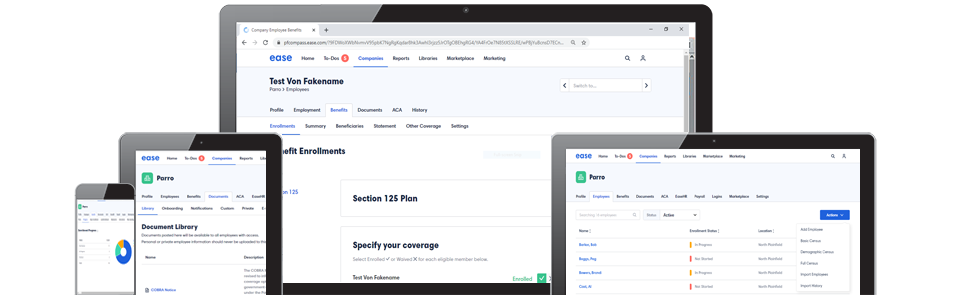

If your company is between 2 and 500 lives, PF Compass has you covered. Employers today are blindsided by double-digit renewal increases because their current representation hasn’t provided them with a blueprint to manage their employee benefit options.

Our Services

Many of today’s broker/consultants are only seen at renewal or when a claims issue arises. Unfortunately, many businesses are unaware that there is so much more their broker/consultant should be doing. At PF Compass we go well beyond what has become common broker responsibilities.

Our Clients

We work with all types of businesses, large and small, across a wide range of industries. Over the years we have created a reputation of providing quality group benefits and unmatched service for all our clients.

LATEST FROM PF COMPASS

Is Your Benefits Broker Earning an A?

A Post-Renewal Checkup for HR Leaders & Business Owners For most employers with a January 1 medical renewal, the heavy lifting is finally behind you. You’ve reviewed plan options, assessed costs, communicated updates to employees, and locked in your benefits strategy for the coming year. But before you move on, this moment presents an important opportunity. How well did your benefits partner actually guide you through the renewal process? To help employers reflect on that question, we created a quick, two-minute Benefits Partner Evaluation — a simple way to assess whether your current advisor delivered the level of strategy, communication, and support your organization deserves. The evaluation is built around five essential components of a high-performing benefits partner. As you read through the sections below, compare your renewal experience to what best-in-class service should look like. 👉 Start the Benefits Partner Evaluation here: https://www.flexiquiz.com/SC/N/benefits-partner-report-card 1. Plan Design & Optimization...

read moreComplimentary Plan Review

Fill Out Our Contact Form: