As healthcare costs continue to rise and employee expectations evolve, group healthcare benefits are undergoing a major transformation in 2025. Employers are no longer just offering coverage—they’re strategically designing benefits to attract talent, manage costs, and support employee well-being. Here’s what’s trending and how PF Compass can help your organization stay ahead.

Key Trends in Group Healthcare Benefits

- Level-Funded and Self-Funded Plans

Smaller businesses are increasingly adopting level-funded plans, which combine the predictability of fully insured premiums with the cost-saving potential of self-funding. These plans offer more flexibility and transparency, especially when paired with strong analytics and claims support.

- Personalized Plan Designs

Employers are moving away from one-size-fits-all coverage. Popular options include:

- High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

- Wellness incentives and mental health support

- Telehealth services and preventive care programs

- Cost Management Strategies

With healthcare costs projected to rise by over 9% in 2025, employers are:

- Increasing employee contributions

- Conducting pharmacy contract reviews to manage specialty drug costs

- Steering employees toward high-performance provider networks

- Technology-Driven Benefits Administration

HR tech platforms are streamlining enrollment, compliance, and communication. Employers are leveraging AI tools to personalize benefits and improve utilization.

How PF Compass Can Help

PF Compass is more than a broker—it’s a strategic partner for businesses navigating the complexities of group healthcare benefits. Here’s how they add value:

✅ Comprehensive Plan Reviews

PF Compass offers complimentary plan reviews to help employers assess their current benefits, identify gaps, and uncover cost-saving opportunities.

✅ Customized Benefit Strategies

Whether you’re a company of 5 or 500+, PF Compass tailors solutions to your workforce’s needs. They work with all major carriers and offer:

- Creative plan designs

- Compliance support

- Claims adjudication

- COBRA administration

✅ Education & Communication

PF Compass bridges the gap between benefits and understanding. Their team provides clear guidance to help employees make informed decisions—reducing stress and improving engagement.

✅ Technology & Support

Clients receive access to simple, effective platforms with live support, making benefits administration seamless and scalable.

⚖️ Compliance & Regulatory Support

Navigating healthcare regulations can be overwhelming. PF Compass helps employers stay compliant with:

- ACA reporting and tracking

- ERISA and COBRA requirements

- HIPAA privacy and security standards

- State-specific mandates and updates

Their team monitors legislative changes and ensures your benefits program remains compliant—protecting your business from costly penalties and audits.

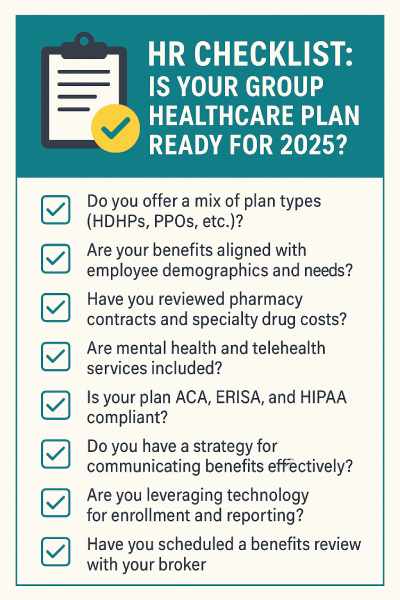

HR Checklist: Is Your Group Healthcare Plan Ready for 2025?

Use this quick checklist to evaluate your current offerings:

✅ Do you offer a mix of plan types (HDHPs, PPOs, etc.)?

✅ Are your benefits aligned with employee demographics and needs?

✅ Have you reviewed pharmacy contracts and specialty drug costs?

✅ Are mental health and telehealth services included?

✅ Is your plan ACA, ERISA, and HIPAA compliant?

✅ Do you have a strategy for communicating benefits effectively?

✅ Are you leveraging technology for enrollment and reporting?

✅ Have you scheduled a benefits review with your broker?

Ready to Optimize Your Group Healthcare Benefits?

PF Compass helps employers take control of their benefits strategy—reducing costs, improving employee satisfaction, and staying compliant. If your current broker only shows up at renewal, it’s time for a change.

Brian Honan | Partner

PF Compass Employer Guidance & Benefit Solutions

440 Route 22, E., Suite 190

Bridgewater, NJ 08807

Tel (973) 732-0697

![]()